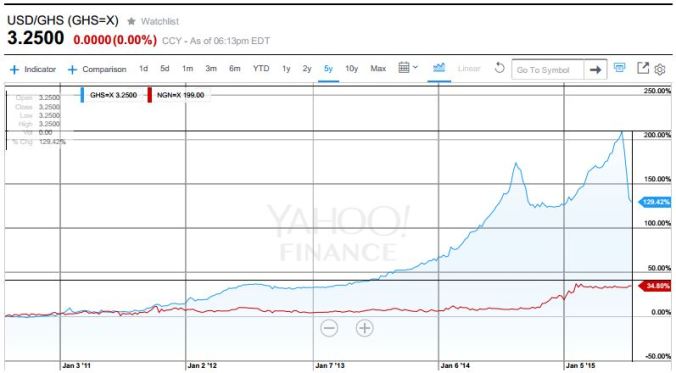

Picking up from where we left off, i.e So The Economist thinks Godwin Emefiele should be sacked? Part 1. I’ll start with a personal story. I had been saving up some money for a while to buy some stuff. The stuff were priced in USD as were my savings. Since it was gonna be at least a year till I reached the target I had a bright idea. USD interest rates are something like 1% pa at best and I could get about 10% pa in naira. Given the relative stability of the naira I decided to change the savings to naira to get the better returns with the aim of changing back to USD when I hit the target. Lol! Dreams! When the first wave of devaluation hit I wanted to cry, my savings were now lower in USD than when I put them in even after accounting for the interest earned. Looking at the data that was there, I should have seen it coming and gotten out earlier – and it was clear, this was not going to be the only devaluation. In the ensuing pain and uncertainty, what were my actions:

- I tried to pull out my money to the safer currency (USD): problem was the investment had a tenure and many people were trying to do the same. The slide was daily, especially on the black market which was all I had access to given Nigeria’s rules for accessing forex even back then. Oh the pain!

- After a couple of back of the envelope calculations I decided ok, within a band I can recover the losses. But to give me added confidence and adjust for the risk I was going to negotiate a higher rate from the bank before rolling over.

It’s interesting how the actions of little me and my puny savings mirrors the behavior of large “foreign investors” in the face of uncertainty with a currency. They come here seeking the higher returns and will pull out at the first signs of danger leaving the stock market reeling or sending yields on bonds up as the interest rates are adjusted for the perceived risks. Ultimately they won’t bring the money back unless they have a fair idea of how the state of play will be. And that’s where we are now, many investors and analysts think that the CBN doesn’t really know what it’s doing and are standing by for an inevitable further devaluation as Standard and Poor’s put it. The tolls on the stock market are evident, as Bloomberg reports the Nigerian Stock Exchange has posted losses for seven weeks straight. What Mr. Emefiele therefore stands accused of is eroding confidence and making stakeholders fret.

“Whereas many investors were impressed by the previous CBN governor, Lamido Sanusi, who was sacked for exposing corruption, they fret about the harm being inflicted by the current one.” – The Economist

That view is echoed by others. A few more quotes from a BloomBerg report below.

“Emefiele is ‘putting off painful and inevitable adjustments’ in the exchange rate” – Bank of America

“He replaced arguably the most effective and outspoken central bank governor that we’ve seen in African emerging markets for some time… It’s only natural to think there’s less independence at the central bank.” – Aberdeen Asset Management

And it’s not only foreign investors who are thinking this. In the words of First Bank of Nigeria’s CEO as reported in Bloomberg,

“People just don’t believe the central bank has what it takes to sustain the exchange rate at the present level. The market needs to reopen. You cannot peg the naira at a level that the whole world knows is unrealistic.” – Bisi Onasanya

But what is the take of the CBN in all this, since like my people say Agbejo enikan da, agba osika ni (he who judges based on one side of the story is a wicked soul).

The CBN actually responded to article in The Economist to state their reasons, I’ll summarize below and add a couple of comments about what I think. You make your decision.

- “The Nigerian economy is heavily dependent on imports and the exchange rate pass-through to inflation is high.” Since we import almost everything we consume, further devaluation will make everything more expensive and we don’t want that. On the face of it that is an excellent point. Difficult to argue with. Or is it? The CBN aims to maintain the inflation (how much prices increase year on year) within a band of 6% – 9%. So policy decisions will be made to keep things within that band. Well, according to data from the CBN website this morning, inflation now stands at 9.2% and is on an upward trend. The reason is simple, while the CBN says the official rate is 197 to the dollar, most people cannot access dollars at the official rate due to rules introduced by the CBN themselves. So with the black market rates knocking on 240 to the dollar, a fair portion of people are already trading at a devalued rate and hence the higher inflation we purport to avoid is already here.

- “Adjustments to a sharp decline in supply of American dollars cannot all be borne by an indeterminate depreciation… The demand side also has to be considered, not just in response to the pressure on the Naira but as an opportunity to change the economy’s structure, resuscitate local manufacturing, and expand job creation for our citizens.” Demand and Supply. The supply of dollars has reduced and hence it’s more expensive, why don’t we reduce the demand for it? Because clearly if restrictions are not put on how quickly the foreign reserves are being depleted, we will run out of dollars soon enough. So, if people would just stop trying to import everything and choose to make them in Nigeria instead then we won’t need so many dollars in the first place and the naira can breathe. Another excellent idea. I have nothing against all those good things quoted above but the question is, is this the best way to go about it? People import either because the stuff is not available in Nigeria or because it’s cheaper to bring it in. If it’s not available in Nigeria and it can be made/grown/conjured here, the way to make it happen is to find the obstacles and dismantle them, that is not the job of the CBN. If it’s cheaper to bring it in than make it here, it goes without saying, if you devalue your currency then the imports become more expensive giving your locally produced versions a chance to compete (Note that this will only work if the key inputs to your production can be locally sourced). In a sense by directing more and more people to the parallel market the CBN is already doing this, which leads to the next point.

- “…the article believes the CBN should adjust to reflect the current parallel market rate, why was this suggestion not made in the week following the inauguration of president Muhammadu Buhari when the same rate fell sharply to under N190 per dollar?” This one is about the difference between black market rates and the official rate. The CBN is saying the black market rate is not a real indicator of what the exchange rate should be contrary to what everyone else is saying and cites the dramatic recovery to 190 just after the elections as evidence. I think using a blip as evidence isn’t best practice. The truth is the trend in the black market has been downward consistently and the gap between the official and parallel rates is a cause for concern. How so? That’s how you make thieves. The CBN continues to supply dollars at the official rate to a select few that meets its criteria, but with a 20% profit to be made from buying at the official rate and selling at the parallel market I can assure you that there are many scams ongoing right now designed to milk that differential. All the best policing that. Additionally the CBN itself said the convergence of the official and parallel rates was a sign of a working system in the past, I guess the position has changed.

Talking about changing positions, the CBN actively pursued a policy of improving liquidity in the forex market and better market determination of the rates in the past. That stance seems to have changed, the actions at the moment are defensive and people can smell blood. Tightening liquidity has been the result and this is a major concern as people hold back from investing in Nigeria. JP Morgan tracks Nigerian bonds in their Government Bond Index for Emerging Markets (GBI-EM). The liquidity concerns led them to place Nigeria on a negative watch earlier in the year, as Reuters reports:

“If we are unable to verify sufficient liquidity in Nigeria’s spot FX and local treasury bond market … it will trigger a review … for removal,” JP Morgan said.”Conversely, if liquidity improves and investors are able to transact with minimal hurdles, Nigeria will be removed from index watch negative.”

In summary the CBN is trying to do the right things, I have no doubts about that. But they have chosen to go about it in a roundabout manner and that is affecting investor confidence. My personal opinion is that the CBN should concern itself with restoring liquidity and confidence to the market and let the naira find a new level. If that requires further devaluation, then that is what should happen. Maintaining an artificial rate that no one believes in in to achieve aims that are clearly not happening is a waste of everyone’s time and simply kicks the can down the road. I close with the words of Mr Onasanya from the article previously quoted.

“We need to bite the bullet and move on, or there will be repercussions over the longterm.”

P.S. I don’t think he should be sacked, that’s a little drastic. What do you think?